Economic Synopses looks at China’s supply of foreign reserves and potential effects on the U.S. economy.

Federal Reserve Economic Data

Announcements

On Fiscal Policy

Economic Synopses describes why deficits are expected to persist and debt is projected to grow.

FRED’s New Look

New FRED design launches in June. Be among the first to see it! GDP never looked so good!

“Do I look OK?” Weigh In on FRED’s New Suit

FRED will launch a new design at the beginning of June and we want your feedback now! The new site is here—with bigger graphs, refined menus, and updating metadata above the graph.

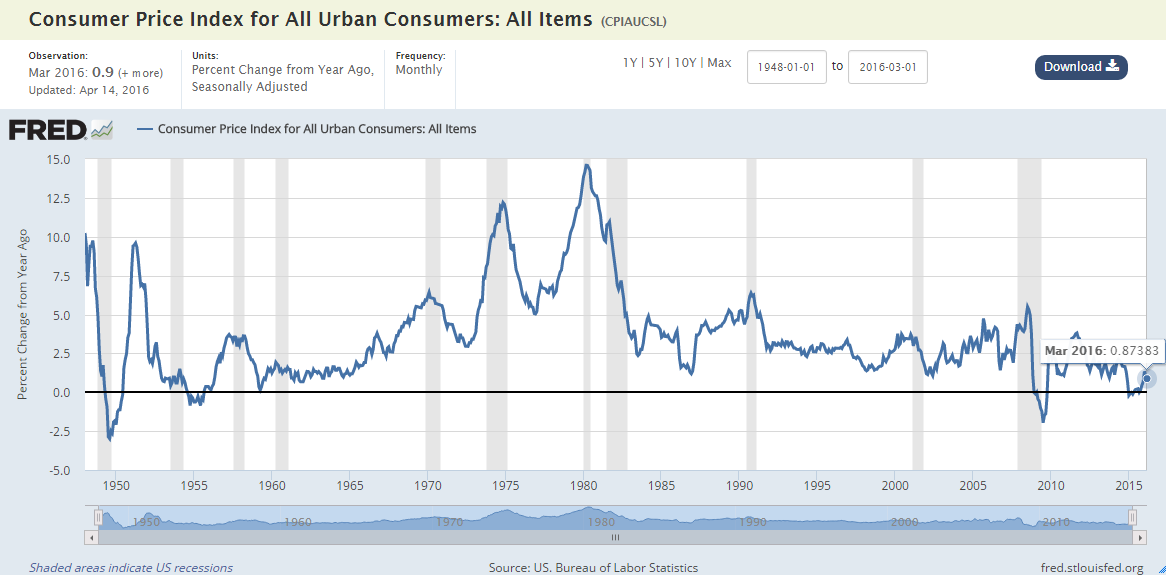

See this graph of CPI: We changed the units to percent change from a year ago. The rate of inflation appears in the metadata above the graph and point by point when you hover over the graph.

You can also easily create graphs that update: The observation range of this graph always updates to show the last month of daily 10-year TIPS.

Please check out the site and let us know what you think. As always, thanks for using FRED.

Econ Info Conference: Seeking Proposals

The St. Louis Fed’s Beyond the Numbers conference is Oct. 6-8, 2016. You can submit a proposal for a session, panel, workshop, or lightning talk. Deadline: May 31.

“Beyond the Numbers” Conference Seeks Proposals

Do you have a great idea on how to provide economic information to the masses? Submit a proposal to the St. Louis Fed’s Beyond the Numbers conference held October 6-8, 2016. This event aims to provide librarians and info pros with the knowledge, competence, and enthusiasm to disseminate economic information expertise to their respective audiences. You can submit a session, panel, workshop, or lightning talk. For more details, check out the conference website. The deadline for proposals is May 31.

CFSI Temporarily Unavailable

The Cleveland Financial Stress Index (CFSI) is temporarily unavailable due to the discovery of errors that overestimated stress in the real estate and securitization markets. Additional details will be made available when posting of the index is resumed.

FRED-MD Has Been Updated

The FRED monthly database for macroeconomic research (FRED-MD) now includes the April 2016 vintage. This database, designed for the empirical analysis of “big data,” is described in detail in a St. Louis Fed working paper by Michael W. McCracken and Serena Ng.

A Primer on Soft Skills

Page One Economics provides the basics on soft skills in the workplace.

Weekend Gas Prices

Economic Synopses reveals the weekly cycle of Midwestern gas prices.